Max Retirement Plan Contribution 2024

Max Retirement Plan Contribution 2024. The irs increased 2024 contribution limits for 401(k)s, 403(b)s, and iras. Until then, here are the limits for 2024 retirement plan contributions, as verified by the irs.

Other key limit increases include the following: The maximum amount you can contribute to a 457 retirement plan in 2024 is $23,000, including any employer contributions.

Of Note, The 2024 Pretax Limit That Applies To Elective Deferrals To Irc Section 401 (K), 403 (B) And 457 (B) Plans Increased From $22,500 To $23,000.

The employee contribution limit for 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023.

The Ira Contribution Limits For 2023 Are $6,500 For Those Under Age 50 And $7,500 For Those 50 And Older.

Other key limit increases include the following:

Until Then, Here Are The Limits For 2024 Retirement Plan Contributions, As Verified By The Irs.

Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), Contribution limits for 401(k)s and other defined contribution plans: The limits differ depending on the type of plan.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, 2024 401(k) and 403(b) employee contribution limit. Here are the new maximums for 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2022 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, HSA, For 2024, the 401(k) annual contribution limit is $23,000, up from $22,500 in 2023. 2024 retirement account contribution amounts.

Source: www.nextgen-wealth.com

Source: www.nextgen-wealth.com

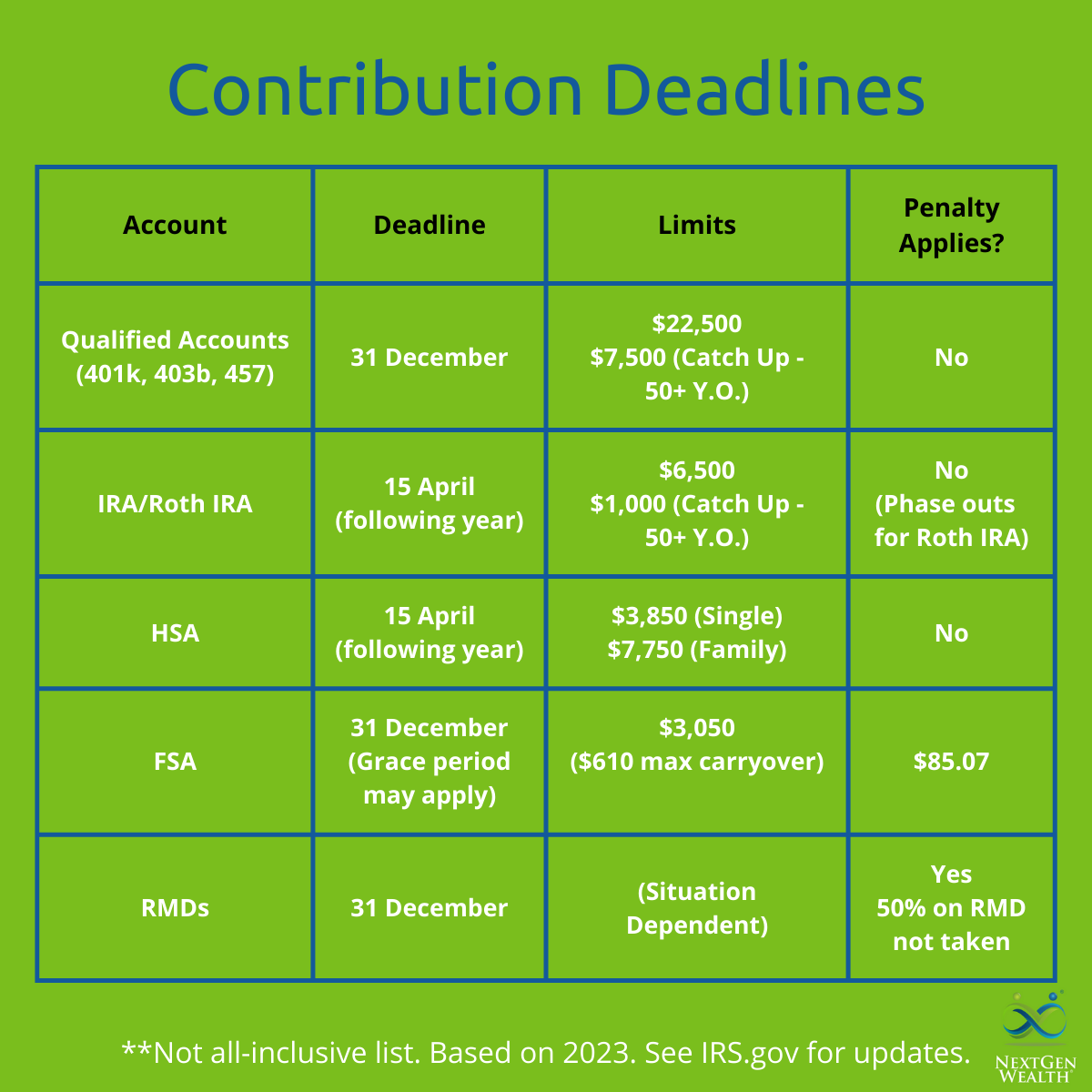

Important Retirement Plan Contribution Deadlines for 2023, 2024 retirement account contribution amounts. For 2024, the ira contribution limits.

Source: socialk.com

Source: socialk.com

Annual Retirement Plan Contribution Limits For 2023 Social(K), Combined employee & employer contribution limit: The ira contribution limits for 2023 are $6,500 for those under age 50 and $7,500 for those 50 and older.

What’s New for Retirement Saving for 2024?, For 2024, the 401(k) annual contribution limit is $23,000, up from $22,500 in 2023. Contribution limits for 401(k)s, 403(b)s, most 457 plans, thrift savings plans (tsps), and other qualified retirement plans rise were $23,000 for 2024, rising from.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, Some retirement plans have lower limits, so check the. The effective date for 2024 limits is.

Source: lanaqrobina.pages.dev

Source: lanaqrobina.pages.dev

Maximum Defined Contribution 2024 Sandy Cornelia, Contribution limits for 401(k)s and other defined contribution plans: Combined employee & employer contribution limit:

Source: www.financialsamurai.com

Source: www.financialsamurai.com

2023 Retirement Plan Contribution Limits 401(k), IRA, Roth IRA, Some retirement plans have lower limits, so check the. Employees with 401(k)s, 403(b)s, most 457 plans, and federal thrift savings plans can contribute up to.

Source: sandboxfp.com

Source: sandboxfp.com

2023 Contribution Limits for Retirement Plans — Sandbox Financial Partners, Those 50 or older can contribute up to $30,000. Employees can contribute up to $23,000 to their 401(k) plan for 2024 vs.

401(K), 403(B) And 457 Elective Deferral Limit $23,000.

The employee contribution limit for 401(k) plans in 2024 has increased to $23,000, up from $22,500 for 2023.

Workers Who Contribute To A 401 (K), 403 (B), Most 457 Plans And The Federal Government’s Thrift Savings Plan Can Contribute Up To $23,000 In 2024, A $500 Increase.

Those 50 or older can contribute up to $30,000.