Long Term Capital Gains Tax Vs Short Term 2024

Long Term Capital Gains Tax Vs Short Term 2024. The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for. Last updated 6 march 2024.

The rates apply to assets sold for a profit in 2024, which are reported on tax returns filed in 2025. The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for.

The Difference Between The Two Is The Length.

Capital gains fall into two main categories:

Last Updated 6 March 2024.

The rates apply to assets sold for a profit in 2024, which are reported on tax returns filed in 2025.

Depending On Your Regular Income Tax Bracket,.

Images References :

Source: www.youtube.com

Source: www.youtube.com

Differences between Short Term and Long Term Capital Gain. YouTube, That’s because it’s not tied to your ordinary income tax bracket. Newly announced inflation adjustments from the irs will.

Source: jemimaqmatelda.pages.dev

Source: jemimaqmatelda.pages.dev

Irs Tax Brackets 2024 Vs 2024 Annis Hedvige, That’s because it’s not tied to your ordinary income tax bracket. The difference between the two is the length.

Source: angeliawliv.pages.dev

Source: angeliawliv.pages.dev

LongTerm Capital Gains Tax Rates For 2024 Dacy Michel, The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for. That’s because it’s not tied to your ordinary income tax bracket.

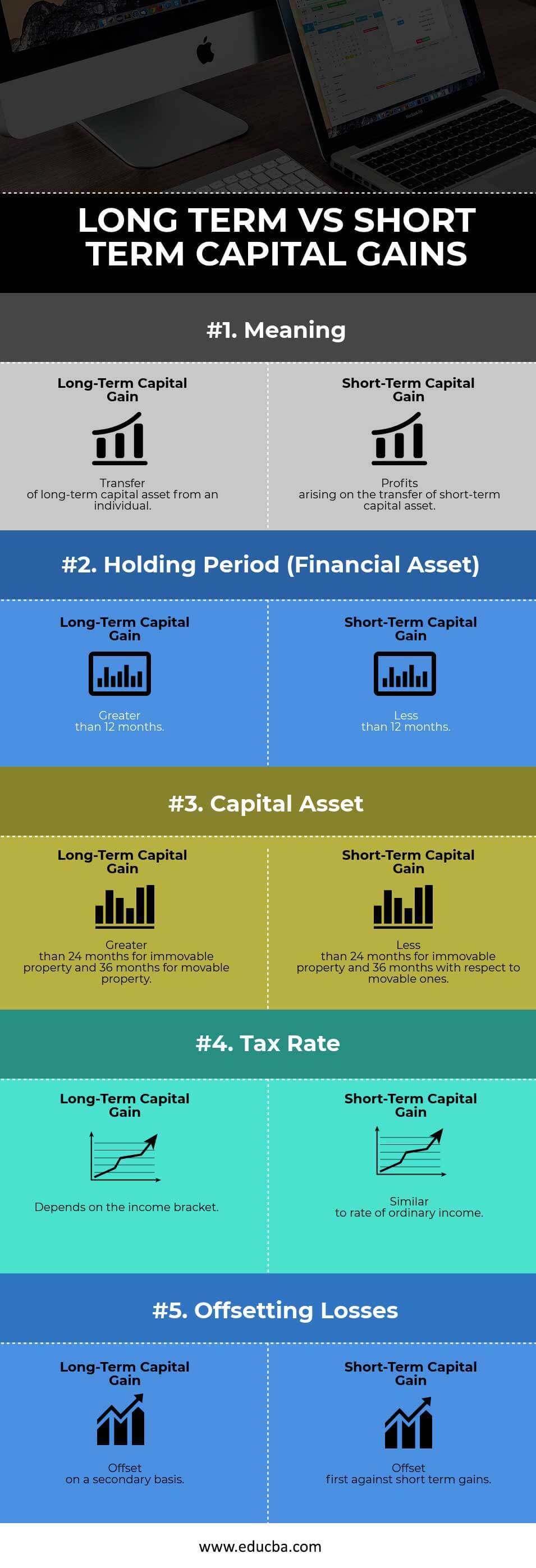

Source: www.educba.com

Source: www.educba.com

LongTerm vs ShortTerm Capital Gains 5 Most Amazing Differences, That’s because it’s not tied to your ordinary income tax bracket. Depending on your regular income tax bracket,.

Source: www.diffzy.com

Source: www.diffzy.com

Short Term vs. Long Term Capital Gain What's The Difference (With Table), The higher your income, the more you will have to pay in capital gains. The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for.

Source: blog.joinfingrad.com

Source: blog.joinfingrad.com

Difference Between LongTerm And ShortTerm Capital Gains!, Depending on your regular income tax bracket,. The capital gains tax rate that applies to profits from the sale of stocks, mutual funds or other capital assets held for more than one year (i.e., for.

Source: kindnessfp.com

Source: kindnessfp.com

Capital Gains vs. Ordinary The Differences + 3 Tax Planning Strategies Kindness, That’s because it’s not tied to your ordinary income tax bracket. Depending on your regular income tax bracket,.

Source: scripbox.com

Source: scripbox.com

Long Term vs Short Term Capital Gain Know the Differences, Capital gains fall into two main categories: The rates apply to assets sold for a profit in 2024, which are reported on tax returns filed in 2025.

Source: taxrise.com

Source: taxrise.com

Capital Gains Tax A Complete Guide On Saving Money For 2023 •, Capital gains fall into two main categories: Based on filing status and taxable.

Source: www.marketstatement.com

Source: www.marketstatement.com

LongTerm vs. ShortTerm Capital Gains What’s the Difference? Market Statement, The difference between the two is the length. The higher your income, the more you will have to pay in capital gains.

High Income Earners May Be Subject To An Additional.

The difference between the two is the length.

Depending On Your Regular Income Tax Bracket,.

The higher your income, the more you will have to pay in capital gains.